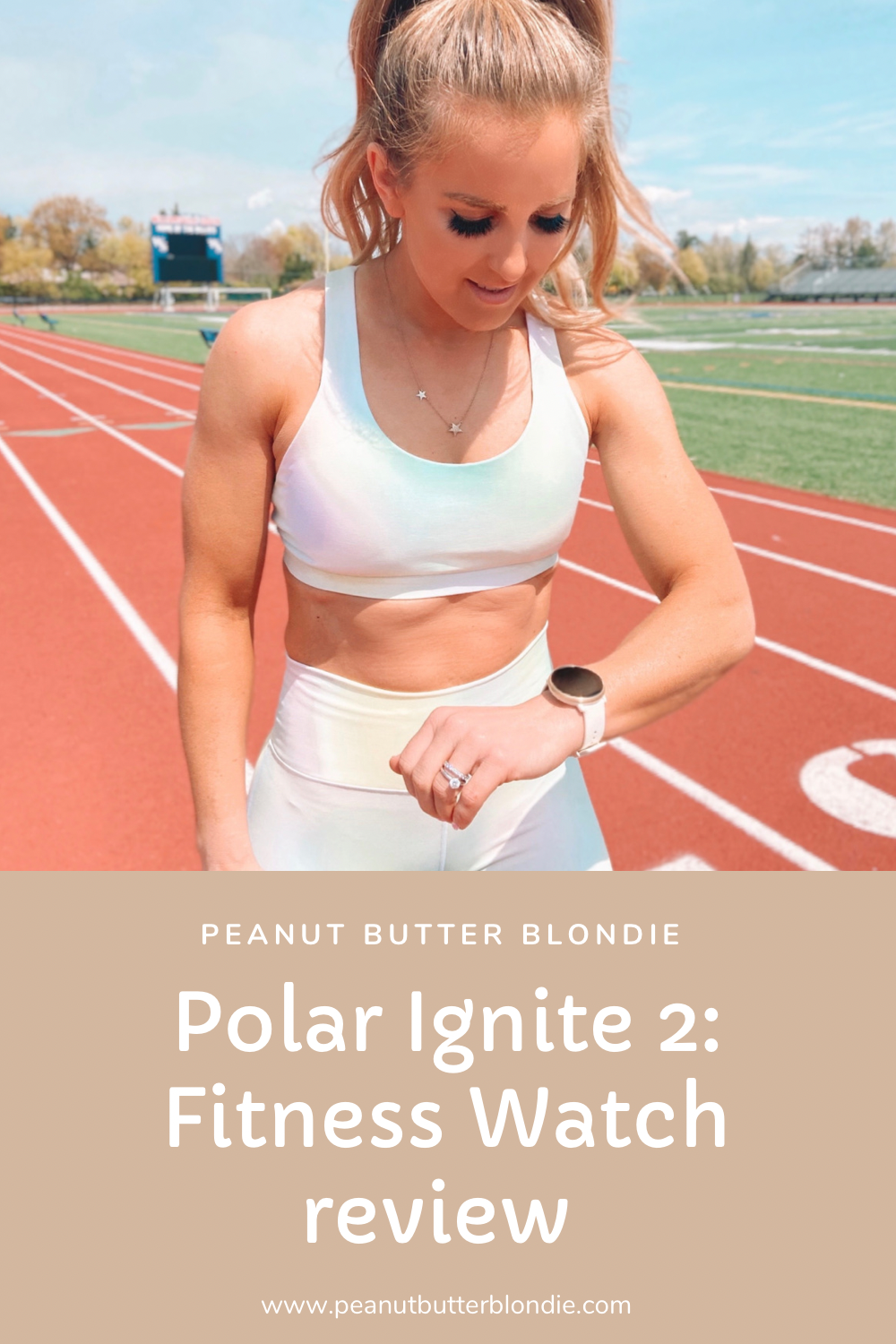

Polar Ignite 2: Fitness Watch Review

This post is sponsored by Babbleboxx on behalf of Polar

Running, working out, and staying active are one of my true passions. Staying active keeps me healthy, positive, and honestly gives me super important “me time” as a mom of three.

Although I’m not competing for NWSL Professional Soccer Trophies anymore, I’m always tracking my workouts for different stats like distance, time, speed, caloric burn, and step count! I almost feel like if I haven’t logged it, it didn’t happen! ;)

Finding a great watch that not only fits my fitness needs, but one that is aesthetically pleasing is not an easy task. I have always wanted to find a fitness tracker that I can go hard in the gym with, but also wear it while at work, running around with the kiddos, or shooting photos for my blog!

I recently tried the Polar Ignite 2 customizable fitness watch and I am LOVING it. This fitness watch has smart features like music controls, weather forecast and push notifications. The watch itself is sleek, stylish, and easy to use. You can even change the watch face to match your current mood and feel confident in any situation!

The Polar Ignite 2 comes with wrist based heart monitoring, personal training guidance (how cool!), sleep tracking, and integrated GPS for all my runs, walks and family bike rides. I love how this helps me understand not only my workouts, but my sleep habits and how I can improve those to better recover, form healthier habits, and come back even stronger!

The Polar Ignite 2 comes in Pink, Storm Blue, Champagne, and Black. There are also a variety of accessory bands to choose from including a crystalized band option with real Swarovski® crystals!

I know I can count on the quality of the Polar watch- Polar not only invented the world's first wearable heart rate monitor but they have been delivering unparalleled insight into training, sleep, and recovery ever since.

Whether you are just getting active, looking to improve your fitness as a mom, or training to maximize your performance as a collegiate, professional or amateur, Polar has a product that is right for you. Polar offer a variety of sports and fitness watches, and gold standard heart rate monitors to fit every athletes’ needs. Check out www.polar.com to see more about their amazing products, including their Polar Ignite 2.

PS. Make sure you check out my Instagram page here where I’m partnering up with Polar to give away one Polar Ignite 2!

Do you have a fitness watch? Have you tried a Polar Fitness Watch?

Thanks to Babbleboxx sponsoring this post on behalf of Polar. As always, all thoughts and opinions are my own.

Xo

Alex